Table of Contents

Over the top

Preface

THE LAST MEDIUM TO BE DISRUPTED BY THE INTERNET

Television is the last of the twentieth-century mass media to be disrupted by the twenty-first century internet. It’s also going to prove to be the toughest. The American television industry is still a cash machine that’s protected by an intricate web of rights deals and inertia. But that’s changing, and rapidly. And when it does, it’s going to change the industry dramatically, making it even better for both creators and consumers.

In the first section of this book, we’ll examine where the industry is today: who the players are, how they interact with each other (who pays who and for what), and what their sweet spots and pain points are.

Next, we’ll look at a number of current trends that are starting to rock the industry, looking at both the business and technology aspects of each and what their road map for the next few years looks like.

Finally, we’ll end with some predictions about where the industry ends up, who the winners and losers are and what TV will look like in the coming decades.

Sit back and enjoy the ride.

Group reading assignment and presentation

- The Television Industry Today:

- Player #1: The Networks: group 1

- Player #2: The MVPDs: group 2

- Player #3: The Studios: group 3

- Player #4: The Premium Networks: group 4

- Player #5: The OTT Services: group 5

- Player #6: Streaming Devices: group 6

- Player #7: Second Screen Platforms: group 7

- Player #8: Smart TVs: group 8

- Summary

- What’s Disrupting The Industry Today

- The Revolution Has Begun: group 1

- Time Shifting: group 1

- Binge Viewing: group 2

- Video On Demand (VOD): group 1

- Second Screen and Social TV: group 3

- Fans and Fan Communities: group 4

- Cord Cutting: group 5

- The Shifting Value Of Ownership: group 5

- Streaming Video Platforms: group 5

- Net Neutrality: group 6

- V-POPs: group 6

- Tablets and SmartPhones: group 6

- Streaming Devices: The New Set Top Boxes: group 7

- The Dominance of Data: group 8

- Future Predictions

- TV Everywhere: group 1

- The Future of Second Screen: group 2

- BYOD (Bring Your Own Device): group 3

- Recommendation and Discovery: group 4

- Non-Skippable VOD: group 4

- New Business Models: group 5

- The Spotifyization of Television: group 6

- A New Revenue Model: group 7

- The Continued Dominance of Data: group 8

- Summary

The Television Industry Today: A Primer For The Uninformed

Player #1: The Networks

- Broadcast Networks1)

-

- C(CBS) + W (Warner Bros) = CW

-

- Cable Networks

- The US cable networks are equivalent of Korean program provider??.

. . . . the larger cable networks tend to draw the same ratings as broadcast networks and, just as importantly, viewers – especially younger viewers who came of age with cable as a given – don’t really see a distinction.

Only business model differences. . . .

Ad Sales:

- National advertising on the show by the network

- Local advertising by carriers or affiliates

- Avenue drops

sig.slightly because of time-shifting viewer behavior.

The A.C. Nielsen company: rating by Nielsen

- three networks era (NBC, CBS, ABC) vs.

- new media era (+ Cable networks)

- Overnights: Nielsen’s next-day ratings

- Outdated methods for rating: Nielsen still relies on a small sampling of households who are tasked with recording their viewing habits in a diary (in pre-internet days, this was an actual handwritten diary).

- TV Everywhere ratings package

- C3, a three-day window rating4): see Nielsen news in 2009 – C3 TV RATINGS SHOW IMPACT OF DVR AD VIEWING

- C7

- L+SD (Live and Same Day) → L+3 (Live and Three days) 5)

- People are also watching a lot more television on their connected devices (smartphones and tablets.) While Nielsen has been working on a solution, none has been implemented to date, and views on those devices go uncounted. We’ll take a closer look at OTT viewing—and how to measure it—later on.

Content license:

- Carriage fees determined by network value + subscribers (MVPD)

- Retrans fee

- Aereo antenna: 스마트미디어 서비스의 저작권료와 관련한 대표적인 분쟁 사례로 미국의 Aereo 사례를 들 수 있다. 미국에서는 2012년 3월 지상파 TV방송을 온라인으로 실시간 시청할 수 있는 서비스인 Aereo가 출시되었다. Aereo 가입자는 ABC, CBS, NBC, Fox 등 미국 4대 지상파 방송 뿐만 아니라 Bloomberg TV 등 30여개 채널을 자신의 PC, 스마트폰, 태블릿PC, OTT 셋톱박스 등을 통해 시청할 수 있다. Aereo는 가입자 개개인에게 HD 방송수신이 가능한 동전 크기의 소형 안테나를 할당해 안테나로 수신된 지상파 방송을 온라인으로 시청할 수 있도록 하였다. 그런데 이 서비스는 지상파 방송사에게 별도의 재전송료를 지급하지 않는다. 방송사 진영에서는 Aereo가 인터넷을 통해 자사 방송을 재전송할 수 있는 권리를 보유하지 않은 채 지상파 프로그램을 가입자에게 전송함으로써 저작권법을 위반하고 있다고 주장하였다. 그러나 Aereo측은 자신들이 지상파 방송 재전송 사업자가 아니라 소형 안테나와 DVR4)등의 시설을 임대하는 사업자로서, Aereo 서비스는 공공을 대상으로 하는 콘텐츠 송출(public performance)이 아니라 가입자 개인의 콘텐츠 이용(private performance)으로 봐야한다고 하였다. 결국 ABC, CBS, NBC, PBS, Univision 등 지상파 방송사들은 뉴욕 남부 지방법원에 소송을 제기하여 Aereo 서비스의 중지 명령을 요청하였다. 그러나 뉴욕법원은 2012년 7월과 2013년 4월 두 차례에 걸쳐 지상파 방송사들의 요청을 기각하였다 ( 스마트미디어 규제체계 관련 주요 논의 동향 및 시사점 PDF ).

- BUNDLING:

- OVERSEAS RIGHTS:

- O&Os AND AFFILIATES:

Player #2: The MVPDs

Multichannel Video Programming Distributors

Comcast, Uverse, DirectTV and the rest.

Two revenue streams:

- Local Ad Sales on the programming they run

- Subscription fees from consumers

The vast majority of MVPDs don’t just sell pay TV packages. They sell broadband and landline services too. The old Triple Play. It’s an incredibly lucrative system for them and an incredibly bulletproof one too.

HOW MANY CORDS CAN YOU CUT? It’s bulletproof because what tech bloggers often forget when they talk about “cord cutting” is that the cord that brings you television is generally attached to the cord that brings you the internet. And if you’re cutting the one, you’re still going to need the other. (To put this in perspective, somewhere over 90% of FIOS and Uverse subscribers get TV and broadband from the same provider.)

So here’s where the genius of this set-up kicks in: the MVPDs will give you two options—get the pay TV service and get unlimited bandwidth (free unlimited bandwidth, in the case of Google Fiber), or, get broadband only, but face possible bandwidth caps. If you’re a heavy TV watcher who plans to get content off web-based services like Netflix and Amazon, you probably won’t wind up saving any money.

The MVPDs are not blind either. They see where the market is going, understand the effect of Netflix and Amazon. And so they are busy cutting deals to include those services in their offering. It’s already happening in Kansas City, where Google Fiber TV has Netflix baked into the program guide with more OTT (Over The Top—the industry term for signals carried over the open internet) channels to come. Smaller MVPDs such as Atlantic Broadband, Grande Communications, and RCN recently announced deals to carry Netflix on their networks, and it won’t be long until the larger players follow suit.

Player #3: The Studios

see also television studio.

While the networks do produce some of their own programming, many TV shows are produced by studios and production companies. These range from studios affiliated with the larger movie studios (Warner, 20th Century, Sony et al) to smaller, independent production companies like Amblin and Bad Robot.

- Hundreds of scripts and winnow to get picked up by cable and broadcast networks.

- A dozen or two will get made into pilots

- The pilots are winnowed down by the network programming executives into the shows that will actually appear on air the following season. (This process is not set in stone and shows with big name stars or big name producers associated with them will often get picked up without having to go through much of the winnowing process.)

How Do They Make Money?

- Programs are picked up by the networks. The networks pay them a fee to run the series and reap advertising revenue from it. Sometimes, if the producer is powerful, they can work a deal where they get a share of the ad revenue. That’s just step one.

- If a series is successful (the holy grail has been 100 episodes, or around four or five seasons), the studio can then sell syndication rights to independent TV stations and networks like USA or TBS that rely on reruns of recent hit shows. Syndication is worth millions of dollars and can continue to line pockets for years.

- In the past few years, Netflix and Amazon (OTT) have become a key source of income for studios too, as they pay top dollar for full seasons of reruns6), which allows for binge viewing. Studios and networks like this arrangement because, (a) it’s very lucrative and (b) if the show is still on air, they can attract new viewers who have caught up via Netflix. Selling prior seasons to Netflix also allows studios to recoup their losses from shrinking DVD sales.

- The final money-making opportunity comes by selling overseas rights: non-U.S. networks and MVPDs will buy rights to the shows, and a hit show can make a huge profit through these sorts of deals as there will be a new deal for each and every market. While it used to take American shows years to make the voyage overseas, the difference between U.S. and overseas launches can now be just days.

THE NETFLIX CONUNDRUM:

UNIONS:

Player #4: The Premium Networks

HBO, Showtime, Cinemax, Red Zone and other sports networks (ESPN, ESPN2, etc.).

- ad-free cable networks that started out showing movies but really made their mark by introducing high quality original content.

- a second “golden age of television”

- a must-have for many Americans, especially the affluent 25-to-54 demographic.

How Do They Make Money?

- Subscriptions called retrans or sub fees. The subscriptions are sold via the MVPDs who collect the money for them and keep a percentage for themselves as a profit. Subscriptions to the various premium networks are often bundled together, so that HBO makes money every time someone decides they want to watch the Showtime series Homeland; chances are good that the upgrade will consist of a premium channel bundle which gives the viewer access to both HBO and Showtime, along with Cinemax, Starz, and some smaller premium networks.

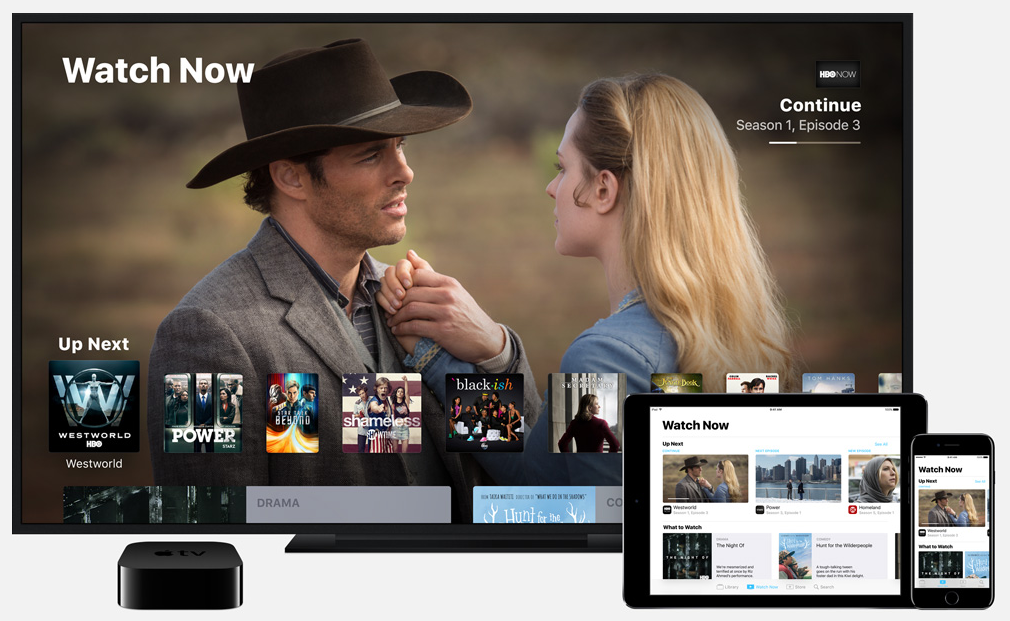

- Not having to collect money from users every month is a huge plus for the premium networks, who also get to rely on the MVPD’s marketing machines to promote their products. It’s one of the main reasons why, despite frequent calls from many in the tech community, many actual industry observers were surprised in October 2014 when HBO announced their decision to launch a standalone app, dubbed HBO Now. In addition to having to do their own marketing, they’d now have to set up billing, accounts payable, and customer service departments and deal with the attendant headaches of running those sorts of divisions. (Recent reports indicate that HBO plans to continue to outsource the aforementioned functions, this time to manufacturers of devices like Apple TV, Roku and Chromecast, and to the MVPDs as well, this time as part of a broadband package.)

- Many observers (myself included) suspect that one of the main reasons HBO is introducing the standalone service is that it gives them an edge in negotiating their carriage deals with the MVPDs: give us what we want or we’ll bolt and take our toys with us. That’s a situation neither side wants to find themselves in, but so long as it’s an option, it gives HBO the upper hand.

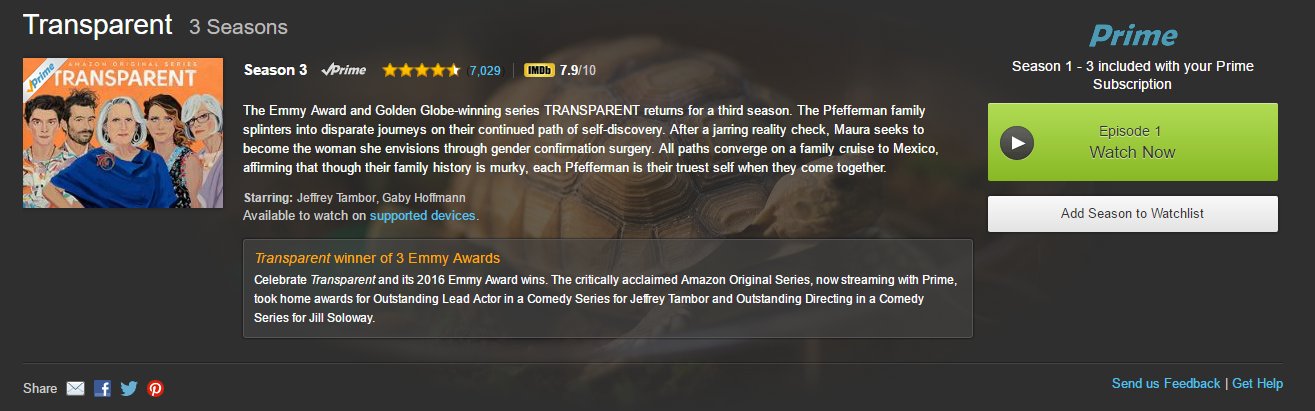

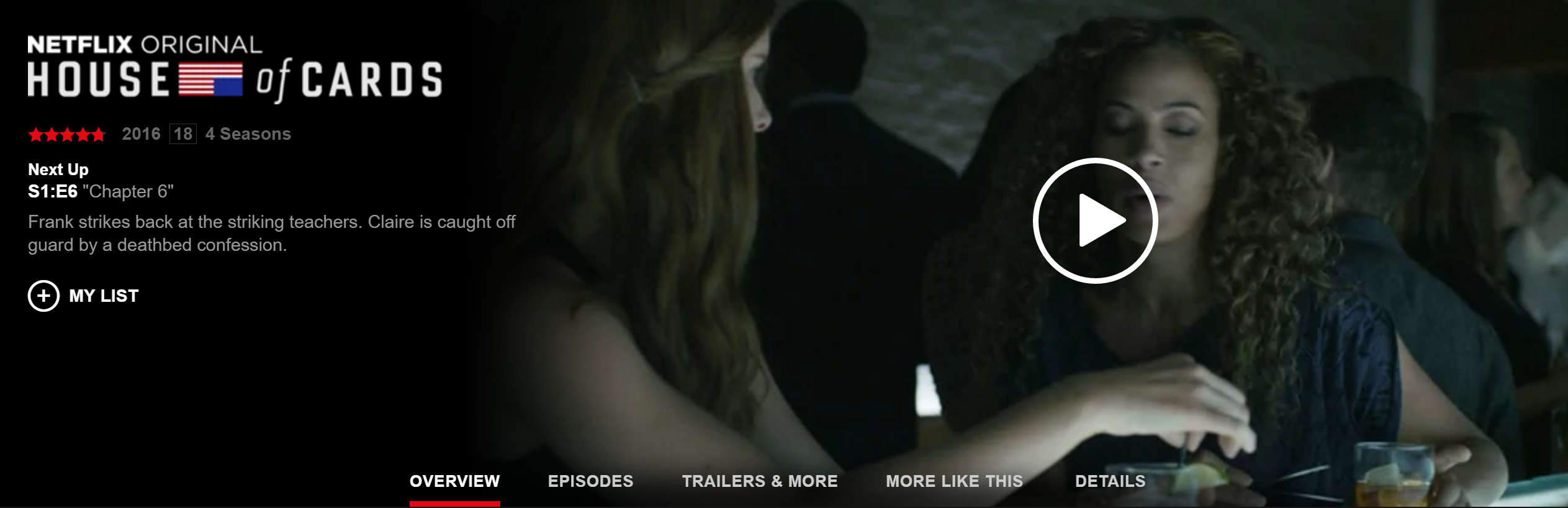

Player #5: The OTT Services

- Netflix, Hulu, Amazon video, Vudu, iTunes7), and all the other streaming services. (youtube red, too8))

- OTT = Over The Top, a reference to how web-based video is delivered – e.g. without a set-top box.

How Do They Make Money?

- Subscriptions: Netflix, Hulu, and Amazon Prime are known as SVOD services – Subscription Video On Demand

- Sales and Rentals. Amazon Instant Video, Vudu, iTunes, et al are known as TVOD service—Transactional Video On Demand

- Subs + Sales and Rentals. Youtube red + Google Music

. . . the OTT networks have all set out to produce original content.

NETWORK CONTENT:

- TV shows, often shot on HD, that people wanted to watch but either hadn’t jumped on the bandwagon at the beginning and now found themselves hopelessly behind, or they’d been too young when the series first aired.

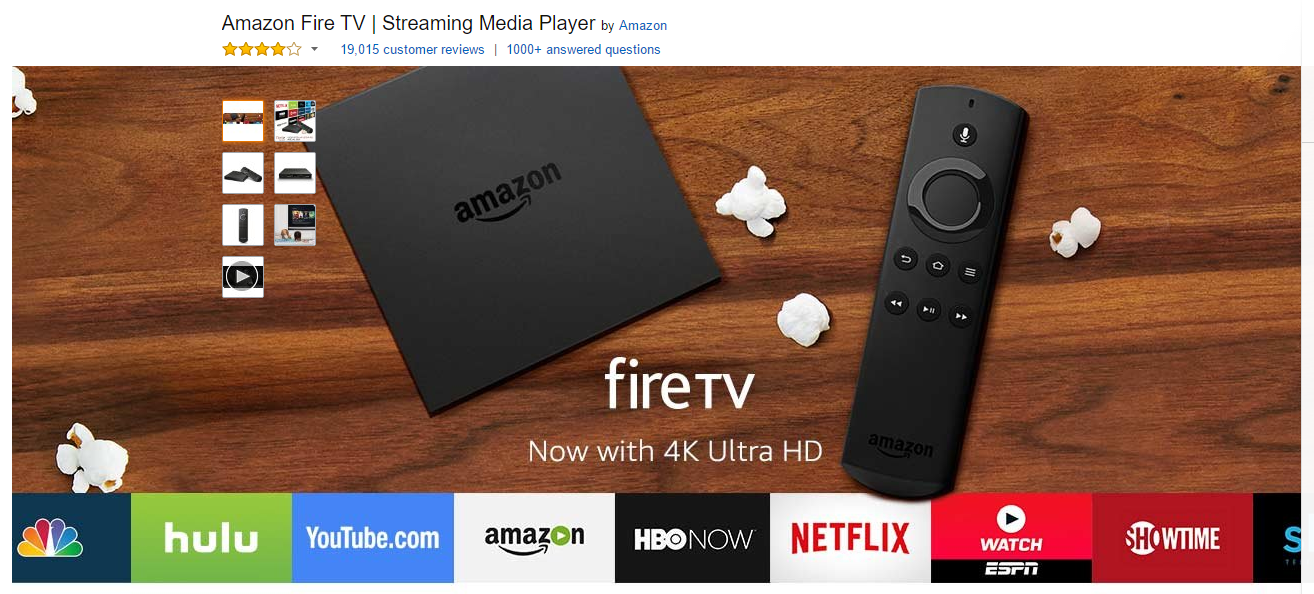

Player #6: Streaming Devices

Google TV – Android TV

Amazon Fire

How Do They Make Money?

- Direct sales to consumers.

- Overlap between Smart TV and Streaming device . . .

- . . . However, the difficulty of updating an $800 TV set versus a $50 Roku would seem to indicate that they will remain as separate devices.

BYOD (Bring Your Own Device)

- BYOD + OTT = cable cord cut + binge watching

- With the possible exception of Comcast, which is building out its own state-of-the-art set-top box, most MVPDs would be happy to see the traditional box disappear.

The only thing stopping them is the fact that many households still have old-fashioned cathode ray analog TVs that won’t work with the streaming devices.

Player #7: Second Screen Platforms

A second screen involves the use of a computing device (commonly a mobile device, such as a tablet or smartphone) to provide an enhanced viewing experience for content on another device, such as a television. In particular, the term commonly refers to the use of such devices to provide interactive features during broadcast content, such as a television program, especially social media postings on social networking platforms, such as Facebook and Twitter. The use of a second screen supports social television and generates an online conversation around the specific content. Second_screen

Activities

- Social activities

- via twitter or something else

- Facebook

- Kakaotalk 단톡방

- It is important to make it exclusive (open to certain types of relationships only such as friends and family) .

- Acquiring information

- 촬영장소정보

- 배우정보

- 선수정보

- 상품정보

- Purchasing service or products

- 상품구매

- 서비스구매

- what else?

- 스포츠도박?

- TV Channel browsing (instead of using television set)

How Do They Make Money?

While “second screen” is a great catchall term, the range of interaction models (let alone business models) makes it difficult to issue grand pronouncements on the entire segment. Each piece currently has its strengths and weaknesses.

Maybe

- Ads on second screen (targeted user and products) see Twitter's TV targeting.

- (shared interests) community provision

SOCIAL TV

- Twitter and Facebook

-

- Nielsen data shows that 95% of U.S households have at least one TV, and the average American watches 5 hours of TV per day

- . . . as many as 87% of consumers are using a second device while watching TV—and for 71% of adults aged 18-34, that device is their smartphone.

- TV Targetting: TV targeting allows networks and brands to promote Tweets to people engaged with specific TV shows, before, during and after a telecast. TV targeting makes it easy for TV networks and brands to easily to promote Tweets to people engaged with specific TV shows, as well as sets of shows, by network or by genre. . . from Twitter.com

- Both Twitter and Facebook have the potential to become drivers for live (same day) tune-in, something the networks desperately need and newer apps such as Snapchat are also poised to take on that role.

APPS

Do viewers really want to look back and forth between their phones and the TV while they’re watching television, and even if they do, is an independent third-party app the way they want to conduct this interaction? . . . .

Player #8: Smart TVs

How Do They Make Money?

Direct sales to consumers. The additional “smart” features are used to justify higher prices than “dumb” HDTVs, though as new features are introduced, the prices for older models tend to drop.

. . . consumers don’t bother hooking up the smart TVs to the internet.

Summary

What’s Disrupting The Industry Today

The Revolution Has Begun

Time Shifting

. . . you had to wait for summer rerun season to catch it again.

VCRs came on the scene in the 1980s

In 2000, a new device called TiVo . . .

. . . but TiVo was quickly elbowed aside by a series of MVPD-supplied all-in-one set-top box/DVR units.

In December 2014, NBC research chief Alan Wurtzel confided that close to 40% of NBC’s programming was watched on a time-shifted basis.

The Diffusion Group confirms . . . that only 53% of viewers look to linear TV as their first option when they sit down to “watch TV.” DVR, VOD, streaming services, and similar options make up the remaining 47%

Popularity of non-linear streaming services

Improved interface of the services

Portability of the services

Time shifting has made a shambles of the ratings system . . . .

Nielsen, the MVPDS, the networks and advertisers are all scrambling to find a way to make sense of a world where close to half of all viewers no longer watch live TV.

Fade out of America's shared moments

Binge Viewing

Why has it not been here?

. . . . the lack of commitment. (monthly payment instead of pay per view)

A lot of programs to binge (old and new) . . . .

. . . . availability of British series

So how popular is binge-viewing? A recent study I did at Piksel showed that over 90% of viewers had binge-watched at least one show, and the behavior showed no sign of abating. (Although it should be caveated that this figure was limited to a specific segment of the population, and that only about 50% of U.S. TV viewers own DVRs.)

The way the show is written has been changed since DVR . . . .

LILLYHAMMER . . . . Netflix’s decision to release all episodes of their original series at once. . . .

Because suddenly the whole notion of linear TV was completely off the table and replaced by the sort of fully on demand line-up many futurists had been predicting.

The effect of this sort of . . . . TV shows will need to be marketed more like movies, with a huge build-up around the initial release date, followed by a combination of paid media and social buzz as follow-through.

Production schedules will feel the impact too. While network TV shows are currently written, filmed, and edited week by week, with writers and actors racing to keep up with constant deadlines, the new series will be able to be shot all at once.

Chasing rating: Data will also come into play as networks will be better able to track viewing habits, understanding how many viewers drop off from episode to episode, who those viewers are and where they live.

Big data: But remember that Big Data is only starting to develop, and its role in the TV industry is still far from clear; data can be used to help make creative decisions, but many fear that data-based decisions cater to the lowest common denominator.

Also providing APIs and others to promote the subsidiary markets

Viewers vs. Users (Passive vs Active)

Video On Demand (VOD)

No notion of binge watching . . . . A lure of live feeding

VOD vs. DVR (commercial skipping tech): VOD with commercials from MVPDs

And . . . networks work too (providing VOD to their viewers).

Netflix, Amazon, Hulu . . . Viewers become loyal.

A large selection of movies from MVPDs

+ Music

+ situation awareness services: Picture frame, Musice, Movie, TV show, Sports

Catchup TV in Europe

Second Screen and Social TV

Quick question: When you’re watching TV, do you talk during the entire show? When the commercials come on (provided you’re not skipping through them) do you only think and talk about the show you’ve been watching?

I’m guessing the answer is no. So then why did so much of the initial activity in the social TV space assume the opposite?

Yes, a lot of people watch TV with a second screen device in hand. But there’s no logical path that says they are using that device solely to interact with whatever is on the screen. Chances are high that if they’ve whipped out the iPhone, they are checking email, looking at a friend’s Facebook photos, checking the score of the game they’re not watching, or some other activity completely unrelated to the what’s on TV.

ACTIVE VERSUS PASSIVE VIEWING

TV as a background distraction – passive viewing

Shows you look forward to and actually care about – active viewing

. . . . During active viewing you’re far more likely to give your undivided attention to what’s happening on the screen, to the point of letting phone calls and texts go unanswered. During passive viewing, there’s not a whole lot of incentive to spend any time talking about a program you’re only casually watching.

Studies show that live sporting events and reality game shows were most likely to get fans interacting (either via Twitter or via polls and quizzes) during the show.

Live . . . Super Bowl, Oscar, presidential inauguration

Sitcomes and reality dramas

Dramas and crime shows

| Types (genre) | Activities | Time |

| sports and live | ||

| sitcoms and reality dramas | ||

| dramas and crime shows | ||

| ? | chatting browsing (intensive) reading | before/during/after |

THE RISE OF SECOND SCREEN 2.0

Many went out of business as consumers showed little interest in checking in to shows or getting recommendations from apps that couldn’t tell them what channel the show was on. Those that did survive kept merging until almost none were left.

So who's left?

TV networks are using that data in four distinct ways:

- To gain and sustain audience

- To make programming decisions

- To give advertisers a better understanding of their audience

- To aid in discovery

TWITTER BOUNCES BACK

Anonymous and synchronous communication.

TV watching is not public behavior.

Engaging with no-known others is not familiar activities?

Twitter is going to begin allowing tweets to runs as native advertising on third party sites.

Going with motion pics!

FACEBOOK AND VIDEO

Fans and Fan Communities

Cord Cutting

The Shifting Value Of Ownership

Streaming Video Platforms

Net Neutrality

V-POPs

Tablets and SmartPhones

Streaming Devices: The New Set Top Boxes

The Dominance of Data

Future Predictions

TV Everywhere

The first thing I see becoming a reality is TV Everywhere (TVE), which is basically what you have now if you have Netflix: you can watch your pay TV service on any device at any time. If you’ve paused a show on your iPad and want to resume it on the TV, you can do that seamlessly.

There are two possible options for TV Everywhere: a system where the MVPDs proprietary TV Everywhere apps prevail, or one where the networks proprietary OTT apps do.

- Former option will prevail:

- A BUILT-IN AUDIENCE OF MILLIONS.

- ALL THOSE AD DOLLARS. Thanks to this built-in potential audience of millions, selling ads on the operator TVE apps will be much easier when compared to other OTT TV apps. As the networks start to see the ad revenue flow in, they’ll become less resistant to the idea of striking deals to put their shows on the operator apps.

- EASE OF USE. Integration to the existing STB.

- THE MVPDS CONTROL THE INTERNET. “ . . . but for five dollars more we can throw in our basic pay-television package with 35 channels and a free TV Everywhere app.”

- BUT, MVPDs have been bad at UI

Personalization. Your personalized account will also mean that you will receive advertising that is specifically targeted to you, based on your tastes and interests, even your recent credit card activity.

It's important that advertisers understand that it's going to be increasingly harder for a generation raised on Netflix and iTunes to go back to a model that relies on four- or five-minute commercial blocks. They’re just not going to take it and will seek out alternate means (pirating, cloud DVRs) of viewing to avoid painfully long commercial breaks. But give them shorter, more relevant blocks, throw in a timer to show just .

. . .

IN-HOME VERSUS OUT-OF-HOME

- Out of HOME

- needs WIFI and/or cellular DATA plan to catch up with . . . .

- IN-home

- Abundant Devices at home.

Being able to access TV from any device will also free it from the television set and make it a more personal medium. Meaning that watching TV was always somewhat public— anyone walking into the room could see what you were watching, but with an iPad or similar tablet device, the viewing experience becomes much more private and thus more personal.

UNBUNDLING.

DOWNLOADING

.

https://www.uplus.co.kr/ent/fglt/MbLteRcmTvList.hpi#TabBoxContent_item_1

The Future of Second Screen

Where second screen or additional content works best for most types of programming is after the show is over. And it only works for viewers who are serious fans of the show. Those are the people who are happy to extend the experience. Who are glad when they're able to spend more time with the characters, the actors, the writers, and the producers. Not to mention the other serious fans.

Question about “during” or “post”

- Post-show like DVD extras

- pre-roll ads, banners, PPL, etc.

Social Media

While I see a lot of opportunities for production companies to create experiences around their shows, I’m less optimistic about the chances of Facebook and (especially) Twitter to become a part of this future ecosystem, mostly because I believe their role lies in driving tune-in via paid posts and tweets.

What they do want to hear, though, is what celebrities or media figures have to say. That’s far more interesting and also far more likely to be surfaced via one of Twitter’s new “tweet ads” that live on third-party sites.

BYOD (Bring Your Own Device)

Which is another problem: every year when surveys of the “most hated companies in America” are conducted, several of the MPVDs wind up in the top 10—for many reasons, but the unreliability of their set-top boxes certainly doesn't help.